The Role of Cryptocurrency in Developing Economies

Novinite.com

28 Mar 2025, 12:25 GMT+10

Money, for most people, is something they don?t think about until it stops working. In places where inflation is a distant worry and banks are a permanent fixture on every street corner, the idea of a failing currency or a complete lack of access to financial services seems abstract. But in parts of the world where the economy can turn on a dime?where savings can lose value overnight or a simple bank transfer can take days?alternative financial systems aren?t just an interesting experiment. They?re a necessity.

Cryptocurrency has become one of those alternatives. While its presence in developed economies is often reduced to an investment asset or a speculative gamble, in developing nations, it's something else entirely. It's a way to move money without needing a bank. A means of getting paid when local currencies are unstable. A tool for safeguarding value in places where traditional financial institutions either don?t exist or don?t function as they should. From Nigeria to Venezuela, from El Salvador to the Philippines, people are turning to digital currencies not because they?re fashionable, but because they solve real problems.

Although regulations remain a challenge, it hasn't discouraged adoption. Take Solana. Itshas been a point of interest, and investors monitor theto determine its stability. In contrast to the volatility of Bitcoin, Solana proved itself to be a faster, more scalable blockchain solution. In countries where transaction fees matter, this is notable. The growing popularity of such networks is a testament to an even broader trend: for the majority, crypto isn't speculation?it's access to a more stable financial system.

Why People Seek Sanctuary in Crypto

The reasons individuals use cryptocurrency vary from nation to nation, but there are common threads. To begin with, there's. In nations such as Argentina and Turkey, where the local currency has, individuals are looking for more stable places to store their wealth. Traditional safe-haven assets like gold or the US dollar may not always be on hand, but cryptocurrency is. You don't need a vault or an out-of-country bank account?merely an internet connection and digital wallet.

Then, there's financial inclusion.puts the figure of unbanked adults in the world at nearly 1.4 billion, with most being in the developing world. Cryptocurrencies provide an alternative, where funds can be sent and received without the services of a traditional bank. In parts of the world where remittance fees consume income?where the cost of sending money home to family is 10% for intermediaries?digital currencies present a much lower cost.

The Appeal and the Obstacles

Of course, it's not all smooth sailing. There are obstacles. Developing economies still lack the technological infrastructure to support mass use of cryptocurrency. Internet access remains spotty in some outlying regions, and mobile phone use is still not universal. Even where access is available, digital literacy is not guaranteed. Owning a smartphone does not automatically mean knowing how to use a decentralized exchange.

And then there's the matter of regulation. Governments are wary of cryptocurrencies, and often with good reason. Without proper regulation, digital assets can be used to perpetuate fraud, money laundering, and capital flight. Some nations, for example, like China, have prohibited crypto transactions completely, while others, like India, have flip-flopped between regulation and prohibition. But in countries where there is little trust in the government, people aren't necessarily waiting for official approval before adopting crypto into their daily lives.

A Mixed Bag: El Salvador and Beyond

attempted something new in 2021 when it legalized Bitcoin as a tender. The attempt was ambitious. It was controversial, too. The idea was simple: employ Bitcoin to drive financial inclusion and inject investment. Reality, though, has been complex. While the government imposed take-up through incentives and campaigns of education, though, many Salvadorans are skeptical.

Elsewhere, adoption has been more organic. In Nigeria, where cryptocurrency has been banned but not yet implemented, a booming peer-to-peer trading market has emerged. The country's youth, cut off from traditional financial systems, have embraced crypto for payments, savings, and even business transactions. The same patterns are evident in Kenya and the Philippines, where digital currencies are increasingly prominent in remittances and freelance payments.

What Comes Next?

The future of crypto in developing nations is uncertain, but its path is inevitable. Governments are beginning to look at central bank digital currencies (CBDCs) as a regulated alternative to decentralized cryptocurrencies. Nigeria, for instance, has already launched the eNaira, though its adoption has been sluggish compared to the widespread adoption of privately issued stablecoins. Other nations are watching closely, weighing the benefits of digital currencies against the dangers.

At the same time, blockchain itself is being used beyond the world of money. Decentralized finance (DeFi) initiatives are providing lending and borrowing facilities without the need for banks. Smart contracts are used to facilitate trading and eliminate fraud. Whether the full impact of these technologies is still to be understood, this much is certain: crypto is no longer a specialist oddity. It's becoming part of the financial fabric where it is needed most.

FAQs: Cryptocurrency in Developing Economies

Q: Why are developing countries turning to cryptocurrencies?

A: Most commonly, crypto covers holes where conventional finance is weak. High inflation, currency volatility, and access deficiencies to banking propel people into alternative financial systems.

Q: What are the most significant threats to cryptocurrency adoption within these markets?

A: Regulatory uncertainty, internet and infrastructure limitation, and susceptibility to fraud represent the biggest risks. Price fluctuation also remains a concern with assets like Bitcoin.

Q: Are governments cryptocurrency-friendly?

A: Not many are right now. Some governments, like those in El Salvador, have embraced it, but others have limited or banned its use. Other governments are contemplating regulated substitutes in the form of CBDCs.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Rio De Janeiro Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Rio De Janeiro Sun.

More InformationSouth America

SectionEAM jaishankar meets Italian ministers; discusses trade, investment, IMEC, maritime, security

New Delhi [India], April 11 (ANI): External Affairs Minister S Jaishankar met with Italy's Deputy Prime Minister and Foreign Minister,...

"India-Italy partnership rooted in democratic values, culture, heritage," says EAM Jaishankar

New Delhi [India], April 11 (ANI): External Affairs Minister S Jaishankar highlighted the strong bilateral partnership between India...

India end ISSF World Cup Buenos Aires with 8 medals, including 4 gold

Buenos Aires [Argentina], April 11 (ANI): India concluded their International Shooting Sport Federation (ISSF) World Cup campaign with...

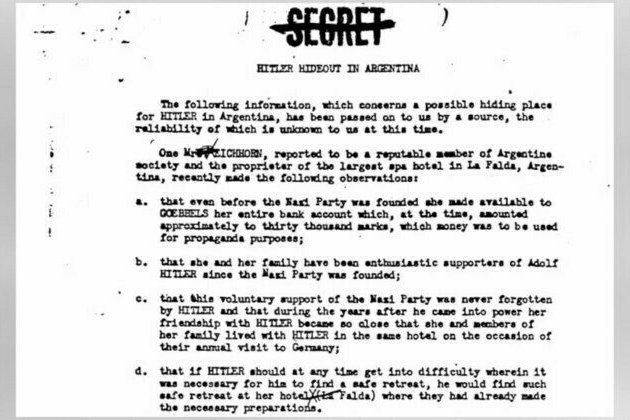

CIA files reveal secret search for Hitler in 1950s

US agents hunted for the Nazi leader in South America for a decade after his supposed death, the documents show The US Central Intelligence...

UAE, Brazil partner to train agricultural professionals in Angola, Guinea-Bissau

ABU DHABI, 10th April, 2025 (WAM) -- In a landmark initiative, the United Arab Emirates and the Brazil Africa Institute (IBRAF) are...

Lincoln American University Celebrates Convocation Ceremony With Hon. Prime Minister Brigadier (Ret'd) Mark Anthony Phillips

SMPL New Delhi [India], April 9: On March 30, 2025, Lincoln American University (LAU) proudly hosted the convocation ceremony for...

International

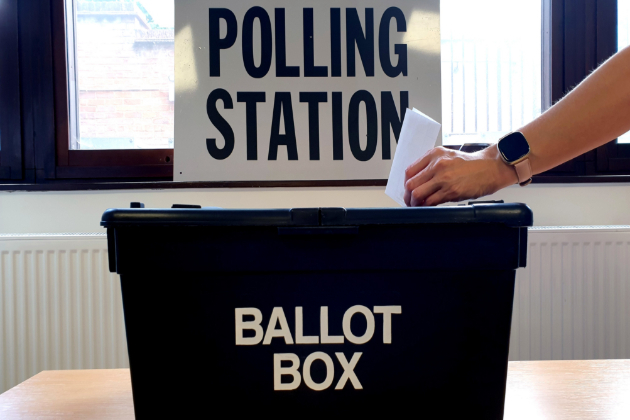

SectionNew Mexico opens primaries to nonpartisan voters

SANTA Fe, New Mexico: More and more voters in New Mexico don't belong to any political party. Until now, they couldn't vote in primary...

Trump administration weighs summer military parade in D.C.

WASHINGTON, D.C.: The Trump administration is in early talks about holding a large military parade in Washington, D.C., this summer—a...

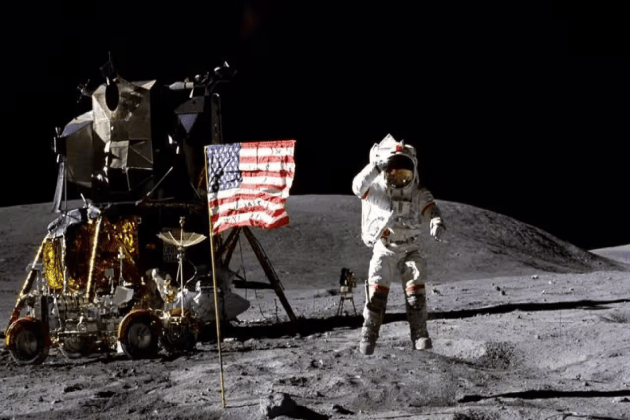

NASA pick backs moon mission as top priority, easing Mars concerns

WASHINGTON, D.C.: U.S. President Donald Trump's choice to lead NASA, Jared Isaacman, has told lawmakers that sending astronauts back...

Mississippi and Kentucky move toward ending income tax

FRANKFORT/JACKSON: It is been about 45 years since a U.S. state last got rid of its income tax on wages and salaries. But now, Mississippi...

Electric utilities feel the heat as AI needs soar

NEW YORK CITY, New York: As artificial intelligence drives soaring demand for data processing, electric utilities across the United...

Deadly storms flood Kentucky, pose threat to lives, homes

FRANKFORT, Kentucky: Heavy rain over several days caused rivers to overflow across Kentucky, flooding homes and threatening a famous...