New US sanctions have negligible impact on Russian oil exports: HSBC Global Research

ANI

21 Mar 2025, 11:42 GMT+10

New Delhi [India], March 21 (ANI): Despite new US sanctions imposed in January, Russian oil exports have remained largely unaffected and continued almost as normal, according to HSBC Global Research.

'Russian exports have continued almost as normal despite new US sanctions announced in January,' says the report.

Supply disruptions are the main upside risk to crude prices, as so far most sanctions-related newsflow has largely been noise and none have materialised. Efforts by India, China, and Russia to restore trade links have helped minimize disruptions, suggesting that any supply disruptions will likely be temporary.

Oil prices have declined in recent weeks, falling to around USD 70 per barrel, as global supply remains strong and economic concerns weigh on the market.

Analysts expect Brent crude prices to average USD 73 per barrel in 2025 and USD 70 per barrel in 2026. Given the combination of strong supply and weak demand growth, the likelihood of prices falling further remains high.

The current market conditions suggest that risks are tilted toward the downside. If global economic activity slows down further--particularly due to US tariffs--demand for oil could weaken, pushing prices lower.

While OPEC+ has the ability to limit price increases by utilizing its spare capacity, there is no similar mechanism in place to support prices on the downside.

If Brent crude prices drop into the mid-USD 60s per barrel, OPEC+ may reconsider its decision and pause the unwinding of output cuts. However, as of now, supply remains strong, and no major disruptions have materialized to counteract the downward pressure on prices.

Additionally, supply from other oil-producing nations has increased, further stabilizing global availability. Overproduction beyond assigned quotas in some OPEC+ countries--such as Kazakhstan, the UAE, Venezuela, and Libya--has added an estimated 0.4 to 0.5 mbd to global supply in February.

If the Iraq-Turkiye pipeline resumes operations, it could add another 0.4 mbd to the global supply.While some supply risks remain--such as potential disruptions in Venezuela or Iran--most sanctions-related concerns have had little real impact on the market.

If global economic conditions weaken further, the oil market could see an even larger surplus, leading to additional price declines.

HSBC report stated, 'We believe risks are asymmetrically skewed to the downside in the current market regime. On the upside, prices remain firmly capped by OPEC+ spare capacity. There is no equivalent mechanism to underpin the downside - quite the opposite, as OPEC+ is set to restore rather than cut supply.'

Report added, 'Prices could fall if global trade and economic activity deteriorate, notably due to US tariffs. If Brent slides to the mid-USD60s/b, we would not rule out OPEC+ pausing the unwinding of its output cuts.'

As a result, the oil market is now expected to be in a slight surplus of 0.2 million barrels per day (mbd) in 2025. This surplus is projected to grow significantly in 2026, potentially exceeding 1 mbd if OPEC+ continues with its planned production increases. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Rio De Janeiro Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Rio De Janeiro Sun.

More InformationSouth America

SectionEAM jaishankar meets Italian ministers; discusses trade, investment, IMEC, maritime, security

New Delhi [India], April 11 (ANI): External Affairs Minister S Jaishankar met with Italy's Deputy Prime Minister and Foreign Minister,...

"India-Italy partnership rooted in democratic values, culture, heritage," says EAM Jaishankar

New Delhi [India], April 11 (ANI): External Affairs Minister S Jaishankar highlighted the strong bilateral partnership between India...

India end ISSF World Cup Buenos Aires with 8 medals, including 4 gold

Buenos Aires [Argentina], April 11 (ANI): India concluded their International Shooting Sport Federation (ISSF) World Cup campaign with...

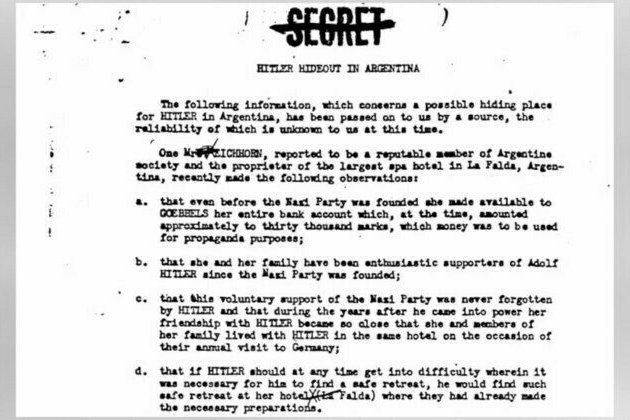

CIA files reveal secret search for Hitler in 1950s

US agents hunted for the Nazi leader in South America for a decade after his supposed death, the documents show The US Central Intelligence...

UAE, Brazil partner to train agricultural professionals in Angola, Guinea-Bissau

ABU DHABI, 10th April, 2025 (WAM) -- In a landmark initiative, the United Arab Emirates and the Brazil Africa Institute (IBRAF) are...

Lincoln American University Celebrates Convocation Ceremony With Hon. Prime Minister Brigadier (Ret'd) Mark Anthony Phillips

SMPL New Delhi [India], April 9: On March 30, 2025, Lincoln American University (LAU) proudly hosted the convocation ceremony for...

International

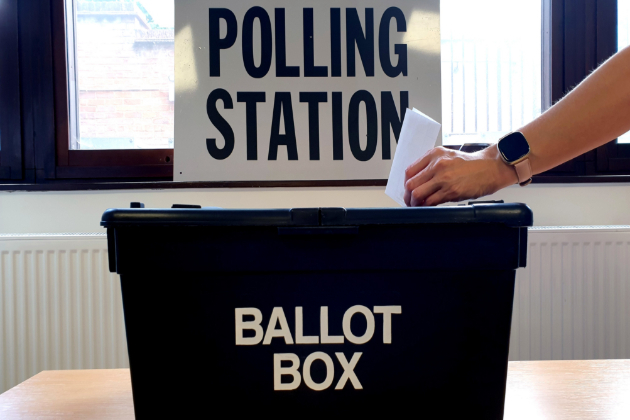

SectionNew Mexico opens primaries to nonpartisan voters

SANTA Fe, New Mexico: More and more voters in New Mexico don't belong to any political party. Until now, they couldn't vote in primary...

Trump administration weighs summer military parade in D.C.

WASHINGTON, D.C.: The Trump administration is in early talks about holding a large military parade in Washington, D.C., this summer—a...

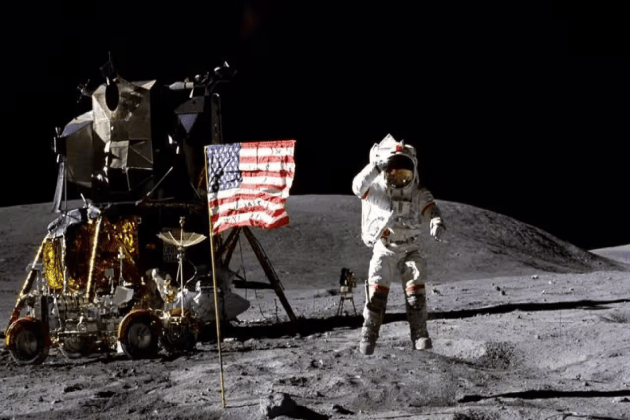

NASA pick backs moon mission as top priority, easing Mars concerns

WASHINGTON, D.C.: U.S. President Donald Trump's choice to lead NASA, Jared Isaacman, has told lawmakers that sending astronauts back...

Mississippi and Kentucky move toward ending income tax

FRANKFORT/JACKSON: It is been about 45 years since a U.S. state last got rid of its income tax on wages and salaries. But now, Mississippi...

Electric utilities feel the heat as AI needs soar

NEW YORK CITY, New York: As artificial intelligence drives soaring demand for data processing, electric utilities across the United...

Deadly storms flood Kentucky, pose threat to lives, homes

FRANKFORT, Kentucky: Heavy rain over several days caused rivers to overflow across Kentucky, flooding homes and threatening a famous...